The emergence of new crypto trends like NFTs, DeFi, as well as the metaverse has further given the chance for people to make investments in the Ethereum blockchain. In the month of October, the hype for metaverse rose as Facebook managed to rebrand itself as Meta which reflected the growth potential in the industry. The ICO boom was made possible by Ethereum’s development of the ERC-20 standard, a protocol for token issuance that acts as readymade infrastructure for blockchain-based businesses. Projects that adhere to the standard enjoy interoperability with other ERC-20 tokens and are simpler to list on exchanges.

On 24 hours chart, ETH after being steady at over $2800 crashed and the price of ETH almost fell below $2700 before it formed an inverted head shoulder form. ETH price could trade lower for a sometime but it may soon surge again. Visit our currency converter page to convert ETH prices to currencies other than USD. Ethereum started with a supply of 72 million ETH to power the network.

How High Will Ethereum Go?

You can buy them on an exchange just like you would any investment. Or you can use a computer to “mine” for them by solving complex math problems using computer software. These math problems get more complex as more coins are mined, in order to control the supply. Price data is calculated using a volume weighted average formula. This formula takes real-time data from numerous Ethereum exchanges and weights the price based on each market’s 24 hour trading volume. A market with a relatively high trading volume will have its price reflected more visibly in the overall average. Many cryptos have become more actively traded this year, and trading volumes could increase as they gain in popularity and acceptance.

A Proof-of-Stake Beacon Chain have been deployed and users are staking their ETH as a sign of confidence of the upcoming network. Research and development are still in progress to roll out the remaining phases. And Ethereum is a combination of both smart contracts and the blockchain. That is why Ethereum provides huge value to this digital world going decentralized.

The Ethereum blockchain isn’t for sale, but anyone can purchase ETH, the token that powers the network. There are several ways to buy in, but most people make their first purchase on an exchange. The hacker stole 3.6 million ETH, worth more than \$60 million at the time and equal to a third of the amount initially raised by the organization. The loophole the hacker exploited was not in the blockchain but in the code written by DAO developers. Participants in the Ethereum network who validate transactions are known as miners. The name is a nod to the 19th century Gold Rush during which miners used shovels and brute strength to extract gold from the western U.S. and Canada. ETH mining relies on a different kind of brute force, raw computing power, to repeatedly guess at answers to mathematical puzzles. Information provided on Forbes Advisor is for educational purposes only.

How high can Ethereum go long term?

The long-term ethereum forecast from Wallet Investor was bullish, projecting that the price could climb to $5,018 in 12 months. The algorithm-based forecasting site’s ETH prediction indicated that the price could surpass $10,000 in 2025 to start 2026 at $11,240. By April 2027, the price could move up to $13,500.

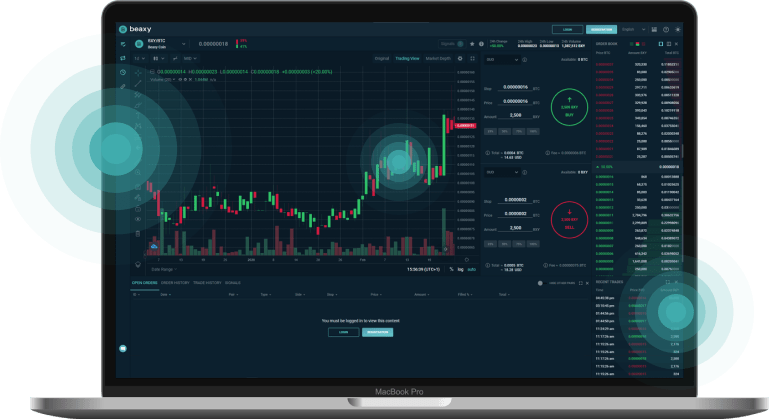

With the help of his co-founders Gavin Woods and Anthony Di Iorio, Vitalik secured funding for the project in an online crowdfunding sale, accessible to the public, that occurred in 2014. The project acquired enough https://www.beaxy.com/ funding to launch the blockchain on 30 July, 2015. The total dollar value of all transactions for this asset over the past 24 hours. The percent change in trading volume for this asset compared to 1 hour ago.

Historical Data

The standard also ensures that tokens will be compatible with desktop, web-based, and hardware wallets. HODLers, or investors who buy and hold cryptocurrency, keep ETH because they believe in Ethereum and expect the value of their tokens to rise. Their perspective steels them through negative news events like the DAO hack, which sent ETH tumbling by nearly 50%. The following year, the token set highs at levels beyond anything seen before the breach. Whether ETH is purchased through an exchange or at a coffee shop, a buyer must have a way to store it. Exchanges provide wallets where customers can keep their coins. Unfortunately, exchange-based “hot wallets” are tempting targets for hackers, and not every exchange will be able or willing to compensate a customer for a loss. If Ethereum didn’t retrieve the money, participants and future investors might have lost confidence in the project. By retrieving it, the community violated first principles, namely that blockchain should be immutable, or unchangeable, and free from interference by a central authority. First proposed by Vitalik Buterin in 2013, Ethereum is a blockchain-based computing platform that enables users to create applications and transfer value around the globe.

Ethereum provides a huge platform to create DApps and deploy them on the ethereum blockchain. There are thousands of DApps and DeFi applications running on this network, and the popularity is constantly increasing of the ethereum blockchain. Because Ethereum is an open-source blockchain platform, security concerns come to the developer because it all depends on them. If they leave a loophole in the system, it might become a serious problem; otherwise, the Ethereum transaction system and token standards provide huge security to the platform. With increasing responsibility as users are growing in their ecosystem and thousands are projects running on Ethereum blockchain, they are working regularly to upgrade the security features. To buy any cryptocurrency, you need to open an account in the crypto exchange. Crypto exchange is a place where cryptocurrencies are trading every day. Specifically, ETH miners attempt to match transaction metadata to a string of letters and numbers known as a hash.

But what’s unique about Ethereum is that users can build applications that “run” on the blockchain like software “runs” on a computer. These applications can store and transfer personal data or handle complex financial transactions. Ethereum is the second-largest cryptocurrency token in terms of market capitalization. Ethereum is a distributed blockchain platform that offers a wide variety of services. It uses Ether to do transactions around the ethereum ecosystem. It allows you to create a smart contract, a permission-less system that executes contracts when the requirement fulfills. Ethereum has excelled in the blockchain and smart contract platform. You can create cryptocurrencies, Dapps, gaming platforms, storage platforms, and many things using blockchain. The smart contract lets you create Defi projects and allows transactions with high speed and security, NFTs and more. The network has since created additional standards such as ERC-721 and ERC-1155.

- For DeFi to succeed, the network must first undergo a series of upgrades.

- By contrast, PoS reaches consensus by paying participants who already control large chunks of the network.

- Ethereum is a blockchain-based software platform that can be used for sending and receiving value globally with its native cryptocurrency, ether, without any third-party interference.

- As transactions occur on Ethereum, nodes are updated with a network-wide accounting of ETH along with the most recent state of each decentralized application, or Dapp.

There are 118,557,345.12 ETH tokens in circulation as of November 2021. The overwhelming performance shown by Ethereum has managed to attract institutional and traditional investors alike. There are some advantages of Ethereum that make it a very popular investment for people. For DeFi to succeed, the network must first undergo a series of upgrades. It is unable to efficiently process high volumes of requests from its users. Developers are working on solutions, but these will take time to test and implement. For holders who are neither bona fide HODLers nor active traders, there are brick-and-mortar businesses that accept ETH for physical goods and services. However, most opportunities to spend the token will be found on the Ethereum network, where it can be used to develop and engage with Dapps. While ETH can be sold directly for fiat, not every exchange provides a fiat off-ramp.

As transactions occur on Ethereum, nodes are updated with a network-wide accounting of ETH along with the most recent state of each decentralized application, or Dapp. Dapps run on smart contracts, programs that facilitate the transfer of value on blockchain. These so-called smart contracts create trust between two parties. First proposed in 2013 by Russian-Canadian computer programmer Vitalik Buterin, Ethereum was designed to expand the utility of cryptocurrencies by allowing developers to create their own special applications. Unlike traditional apps, these Ethereum-based applications, called “decentralized applications,” or dapps, are self-executing thanks to the use of smart contracts. Besides being used as a digital currency, Ethereum can also be used to process other types of financial transactions, execute smart contracts and store data for third-party applications. Bitcoin’s primary use is as a virtual currency and store of value. Ether also works as a virtual currency and store of value, but the decentralized Ethereum network makes it possible to create and run applications, smart contracts and other transactions on the network. Ether can be used to buy and sell goods and services, like Bitcoin. It’s also seen rapid gains in price over recent years, making it a de-facto speculative investment.

Ether is a tradeable cryptocurrency, used by application developers to fuel the Ethereum network. These are just a handful of the applications conceived for Ethereum; the most powerful use cases of this blockchain are yet to be imagined. Ethereum’s challenge now is in garnering of mainstream appeal, something which has so far eluded the platform due to the friction between the traditional and crypto spheres. Some merchants have already begun accepting ether as a means of payment, and that number is likely to grow as consumers look for alternatives to credit cards and other payment methods. In fact, A house was recently sold and the transaction was performed using a cryptocurrency. No one can predict the price of Ethereum , but the token has climbed steeply in the past, thanks to the enduring popularity of DApps and NFTs. As always, do your own research and carefully evaluate cryptocurrencies before exposing yourself to any financial risk.

Not all the founding members are still with the Ethereum Foundation, as some has moved on to work on other projects. For example, Charles Hoskinson has moved on to work on Cardano, while Gavin Wood has moved on to work on Polkadot. By default, Ethereum uses the Proof-of-Work consensus mechanism, but the network is slowly migrating to a Proof-of-Stake as part of its Ethereum 2.0 upgrade. The Ethereum 2.0 upgrade started in December of 2020 with the launch of the Beacon Chain. The ETH community supported this upgrade by staking 1 million ETH in the first week alone. The percentage of Binance customers who increased or decreased their net position in BTC over the past 24 hours through trading. There are three main types of nodes that operate on the Ethereum network.

The pattern of price gains, sudden drops, and gradual rebuilding to new highs has continued to the present, and these patterns help explain the Ethereum price today. The value of Ethereum doubled as 2020 began, then bottomed out at 72 € following a 45% one-day crash in March. A rally followed, which helped Ethereum chart a price of 640 € by the end of the year – an annual price gain of 475%. The crypto market slumped in 2018, and Ethereum slumped with it. Ether lost more than 90% of its value, with ETH worth about 110 € at the end of the year. Considering the YTD chart, ETH has had a rough year so far. From trading over $3800 yearly high in January 2022 to crashing below $2500, ETH price has been very much vulnerable this year.

Its upward march was underpinned by a spike in interest by big Wall Street and tech firms into the cryptocurrency. According to Coindesk, JPMorgan Chase, Microsoft, and a number of other firms joined forces in February to create the Enterprise Ethereum Alliance. The collaborative venture aims to use the Ethereum platform to integrate blockchain solutions into their infrastructures. This website is intended to provide a clear summary of Ethereum’s current and historical price as well as important updates from the industry. Ethereum ERC20 token prices can also be found in the menu options along with other coin data such as BTC, XRP and others. Prices are updated every minute in real-time and the open/close prices are recorded at midnight UTC. There are two popular programming languages that are typically used to write Ethereum smart contracts.

Please Complete The Security Check To Access Www Lunocom

People are started adopting Ethereum as their base network, and thousands of projects are running on Ethereum right now, which is a great value for Ethereum itself. An exchange is a marketplace where parties trade financial instruments. Certain cryptocurrency exchanges, known as fiat on-ramps, allow customers to buy ETH for fiat currencies like dollars, euros, and yen. The volunteers, or miners, use their own computational power to run the network. This involves passing blocks of code between each other and solving the mathematical problems that keep the code secure in exchange for Ether. The currency is listed on exchanges, and can only be used on the Ethereum blockchain. Block rewards are new ether coins that are created when each new block is discovered and are given to the successful miner for their efforts.

As the dApp market and DeFi sector grow, the Ethereum blockchain grows more valuable, making Ethereum worth more. Ether (Ξ) is a cryptocurrency whose blockchain is generated by the Ethereum network. Ether was one of the first altcoins that was launched after Bitcoin and is a key part of the Ethereum network. Ethereum is a platform and it describes Ether as “gas” that fuels the network. Like Bitcoin, Ether is based on blockchain technology, but one of the advancements that its creators brought was the ability to build smart contracts into the blockchain. EthereumPrice.org launched in March 2016 to allow users to easily track the price of Ethereum both historically and in real-time. The platform has since evolved to include several fiat currencies as well as price data for a number of Ethereum ERC20 tokens and other blockchain currencies. More recently, prediction data from Augur was also added to provide insight into the future price expectations of the Ether market. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.

It is difficult to predict how many ETH will be around in 5 or 10 years’ time. The transition to PoS could fail, permitting millions of new tokens. Alternatively, if PoS happens, it would effectively cap the supply. Regardless, Ethereum has already ethereum calculator done more than any platform to increase the range of cryptocurrency options. Thousands of projects have launched from the network as ICOs, or initial coin offerings. Some have left for their own blockchains, but most have stayed put.

Decentralized applications will never go down and can never be switched off. The Altcoin leader Ethereum resisted a lot but now it is in a confirmed down trend. The price is expected to test the resistance of 2900 and 3100 in coming week. My idea is to enter at resistance of 3100 with a target of 2800 and 2600 supports. If you like this or if you think the opposite of this or if there is any other opinion, mention it in the comments.

Coinbase, Binance and Kraken are a few of the larger exchanges. If you are just interested in purchasing the most common coins like Ether and Bitcoin, you could also use an online brokerage like Robinhood or SoFi. Be prepared to pay some amount of trading or processing fees almost universally. With the first block being mined in July 2015, Ethereum has since become the largest smart contract platform of its kind, and the second largest blockchain of all time as measured by market capitalization. Ethereum 2.0 is an upgrade that aims to solve the blockchain trilemma – security, scalability, and decentralization. In alternative smart contract platforms, they are designed to be highly scalable but compromises on decentralization. Whereas a highly secured and decentralized blockchain network would have the trade off being highly unscalable. Ethereum 2.0 brings a very different flavor of design that aims to addresses those issues by way of using Proof-of-Stake , Beacon Chain, Sharding, and Execution Environment. Due to the complexity of the project, the developement will take place in 3 phases.

After every boom and bust cycle, Ethereum comes out the other side with a fundamentally stronger platform and a broader developer community backing it. These fundamental improvements would suggest a positive long-term outlook on the price of Ethereum. Last week, we saw how Ethereum prices have been pushed lower due to negative sentiment around Chinese regulations and concerns over a new Covid-19 variant. This week, we’ll take a look at the sudden crypto price surge we’ve seen in recent days. Cryptocurrencies can be sent or received anywhere in the world, and may offer a lower-cost alternative to bank wires or even ACH payments. This speed of cleared payment can be very important, since checks or electronic transfers can often take days to clear. Funds sent overseas also eliminate the need for currency conversions, since ether is the exact same whether it is in Canada or Japan. Blockchain-based cryptocurrencies have been gaining in popularity as they represent a viable alternative to more traditional payment methods. These cryptos can provide a number of potential benefits, and are considered to be a very convenient means of sending or receiving payments.

Can I buy less than 1 Ethereum?

If you don’t want to buy a whole Ethereum token or don’t have enough money in your account for a full coin, you can purchase a fraction of one. For example, if the price of Ethereum is $2,000 and you invest $100, you will purchase 5% of an Ether coin.

Once a match is found, it is shared across the network, and the underlying transactions are added to the blockchain. Though it’s hard work to find the right hash, it’s easy for nodes to verify that an answer is correct. Before making any significant investment in Ether or other cryptocurrencies, consider speaking with a financial advisor first about the potential risks. Given the high risk and volatility in this market, make sure it’s money you can afford to lose, even if you believe in Ethereum’s potential. A large community ot Ethereum developers is constantly looking for new ways to improve the network and develop new applications. “Because of Ethereum’s popularity, it tends to be the preferred blockchain network for new and exciting decentralized applications,” says Avital.

The Ethereum exchange rate took a big hit as the virus hit home. Ethereum’s success has ironically become a significant factor limiting its growth. All the distributed applications hosted on Ethereum share a total bandwidth of 30 blockchain transactions per second. DApp developers use sharding techniques and Ethereum side chains to work around this limit, but the execution bottleneck is a significant factor behind the growing popularity of alternative blockchains. The overall history of Ethereum value matches what analysts call a boom-and-bust cycle.

#NFT Statistics (Real-Time)

Collection: lonelyalienspaceclub#bitvotsNFT #nonfungibletoken #NFTArtFinance #Ethereum

Follow + RT = ❤ pic.twitter.com/AEsjF2wa9j— Bitvots (@bitvots) May 1, 2022

The price of Ethereum today is $2,819.47 USD, which has increased by 32.76 (1.18%) over the last 24 hours. The total number of ETH coins in circulation stands at 120,606,808 and $361,337,599 USD has been traded for the ETH/USD pair across exchanges over the last 24 hours. The Ethereum protocol officially launched in 2015 and quickly rose to become the world’s second-largest cryptocurrency by market value behind bitcoin. Like Bitcoin, Ethereum has its own blockchain where a global network of more than 2.4 million computers known as “nodes” maintains a record of transactions. Anyone can run an Ethereum node and participate in validating the network provided they have the right hardware, knowledge and time to commit to it. From ether’s official launch date in 2014 to March 2017, the token’s price remained rangebound between $0.70 and $21. It wasn’t until the 2017 bull crypto market started to pick up in May of that year that ETH price went above $100 for the first time. From there, ether skyrocketed to a peak of $414 in June 2017 before correcting. It took another five months for bullish momentum to regain strength.

In the next major phase of development, Ethereum’s Beacon chain will be bridged to the main Ethereum network and will replace the current, energy-intensive proof-of-work system with proof-of-stake. Network stakeholders known as “validators” will begin producing blocks, verifying transactions and managing the security of the blockchain in place of miners after Ethereum and Eth 2.0 are merged. According to the project’s official website, the annual inflation rate of ether is about 4.5%. Block rewards have been reduced two times since the first ever Ethereum block was mined. The reductions in block rewards aren’t programmed into Ethereum’s code like Bitcoin’s halving events are. Ethereum is a blockchain-based software platform that can be used for sending and receiving value globally with its native cryptocurrency, ether, without any third-party interference. Since 2017, DigitalCoinPrice has become one of the trusted brands within the crypto community. This success award goes to the combination of people, accurate crypto market analysis and data, the latest news, latest blogs, advertisement placements, and many more. Vitalik Buterin is the CEO of ethereum and actively working on the ethereum blockchain platform. At the same time, the rest of the founders started rival blockchains, and some left to focus on other industries.

However, since January 2022, ETH has been trading at over $3000 for the most part of the year. Speculations abound for how high Ethereum’s price will get in the future. To register with an exchange, a prospective customer must provide personal details including address history, a photo, and banking information. This is for regulatory compliance and to secure the login process. Once these requirements are squared away, buying can begin.

Avatud: E-R: 10:00 - 18:00

L: 10:00-15:00 P: Suletud

Avatud: E-R: 10:00 - 18:00

L: 10:00-15:00 P: Suletud