Contents:

The content created by our editorial staff is objective, factual, and not influenced by our advertisers. Bankrate follows a strict editorial policy, so you can trust that we’re putting your interests first. Do not include Social Security numbers or any personal or confidential information. Forms, publications, and all applications, such as your MyFTB account, cannot be translated using this Google™ translation application tool.

It provides temporary payments to people who are unemployed through no fault of their own. —Record the sale with the county recorder’s office so the buyer legally owns the property. Have the buyer pay for homeowners’ insurance. A wraparound mortgage can yield 2% of the loan balance in addition to the home sales profit. The California Public Utilities Commission still has to approve the proposal and make a final decision by mid-2024 but it is likely to get the green light. The fixed rate could start showing up on bills as soon as 2025.

How To File Your California Income Tax Return

Qualifying deductions might include an itemized deduction, the California standard deduction, exemptions for dependants, business expenses, etc. Keep in mind that this estimator assumes all income is from wages, assumes the standard deduction, and does not account for tax credits. California has ten marginal tax brackets, ranging from 1% to 13.3% . Each marginal rate only applies to earnings within the applicable marginal tax bracket. Most items are subject to these rates, but there are some exceptions, as well as certain products that face higher rates. Among the products on which sales taxes are not required are most groceries, prescription medicine and utilities like gas and electricity.

It also limits increases in assessed value to 2% every year, except if the home has changed ownership or undergone construction. That law has helped keep Californians’ property tax payments below the national average, and in some cases, significantly so. Next, from AGI we subtract exemptions and deductions to get your taxable income. Exemptions can be claimed for each taxpayer as well as dependents such as one’s spouse or children.

Principles of Sound Tax Policy

The California tax rate is unchanged from last year, however, the income tax brackets increased due to the annual inflation adjustment. The published rate of inflation used to adjust the 2022 income tax brackets was 8.3%. California income tax rate and tax brackets shown in the table below are based on income earned between January 1, 2022 through December 31, 2022.

In some cases, you might be a nonresident for tax purposes even if you live in California but you were out of state for at least 546 consecutive days because of an employment-related contract. Generally, you’re a part-year resident of California if you were a nonresident for some of the tax year. This is often the case for people who moved to California from another state. You’re a resident of California for tax purposes if your presence in California wasn’t temporary or transitory in purpose. Generally, you’re a resident if you lived in California, even if you were temporarily out of state. All income received while a resident, plus income from California sources while a nonresident.

State taxes: Massachusetts

Please contact us if any of our California tax data is incorrect or out of date. This fixed-rate plan would reduce monthly bills for low-income customers and if electricity usage is controlled, bills would also be lowered. It would cost as little as $15 a month for low-income households and up to $85 more per month for households making more than $180,000 a year.

t account‘s free eFile program allows all California taxpayers to instantly file their income tax return over the internet. California provides several free resources for eFile users, including ReadyReturn , and CalFile, a free software program offered by the Franchise Tax Board. In addition, California supports e-filing your return through a variety of third-party software packages. If you are not a resident of California, have a complicated tax return, or have other specialized circumstances you may need to download additional tax forms from the website. You can find all of California’s 2023 income tax forms on the income tax forms page . When calculating your California income tax, keep in mind that the California state income tax brackets are only applied to your adjusted gross income after you have made any qualifying deductions.

Enter household income you received, such as wages, unemployment, interest and dividends. A financial advisor can help you understand how taxes fit into your overall financial goals. SmartAsset’s free tool matches you with up to three vetted financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you.

Tax credit bills may send $1B to poor families – CalMatters

Tax credit bills may send $1B to poor families.

Posted: Wed, 19 Apr 2023 12:30:00 GMT [source]

Some states have a flat tax rate, marginal tax rate, or don’t have any state taxes at all. California has among the highest taxes in the nation. Its base sales tax rate of 7.25% is higher than that of any other state, and its top marginal income tax rate of 12.3% is the highest state income tax rate in the country. The Golden State fares slightly better where real estate is concerned, though. The average homeowner pays just 0.71% of their actual home value in real estate taxes each year. You can save time and money by electronically filing your California income tax directly with the .

The Child and Dependent Care Credit

You can learn more about how the California income tax compares to other states’ income taxes by visiting our map of income taxes by state. E-file fees do not apply to NY state returns. DE, HI and VT do not support part-year/nonresident individual forms. Most state programs available in January; software release dates vary by state. State e-File for business returns only available in CA, CT, MI, NY, VA, WI.

This is not an offer to buy or sell any security or interest. All investing involves risk, including loss of principal. Working with an adviser may come with potential downsides such as payment of fees . There are no guarantees that working with an adviser will yield positive returns.

By authorizing H&R Block to e-file your tax return, or by taking the completed return to file, you are accepting the return and are obligated to pay all fees when due. H&R Block Free Online is for simple returns only. California tax return forms are available on the California tax forms page or the California Department of Revenue. The standard deduction, which California has, is a deduction that is available by default to all taxpayers who do not instead choose to file an itemized deduction.

Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Many municipalities add on local tax as well, which can bring the total sales tax in some areas up to 10.75%. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.

We can also see the progressive nature of California state income tax rates from the lowest CA tax rate bracket of 1% to the highest CA tax rate bracket of 12.3%. California residents are subject to state income taxes. The state uses a graduated-rate income tax system, meaning the more money you earn, the higher your tax rate.

Are Taxes Really Lower in California than in Texas? – Cato Institute

Are Taxes Really Lower in California than in Texas?.

Posted: Mon, 27 Mar 2023 07:00:00 GMT [source]

—If the buyer defaults and the seller doesn’t make the mortgage payment to the underlying lender, the lender could report late mortgage payments to the credit bureaus which could affect the seller’s credit. —The seller makes payments to the mortgage servicer. For example, let’s say you sell your home for $750,000 to Mr. and Mrs. Buyer. You have an existing 2.5%, $600,000 trust deed (California’s technical definition of a mortgage note).

If your total itemized deductions are less than the standard deduction, the calculator will use the standard deduction. Products that face separate tax rates include alcoholic beverages, tobacco products and gasoline. For alcohol and cigarettes, rates are assessed based on the quantity of the product purchased. Cigarettes, for example, face a tax rate of $2.87 per carton. For regular gasoline, there is a 53.90 cent per gallon excise tax. California has its version of the Earned Income Tax Credit.

California Tax Brackets for Single Taxpayers

The top corporate income tax rate is 8.84 percent, according to the Tax Foundation. Overall, the state ranks 48th in the Tax Foundation’s State Business Tax Climate Index Rating. If you filled out physical tax return forms, mail your completed California income tax return to the California no later then April 15th.

- Luckily, we’re here to save the day with H&R Block Virtual!

- The table below further demonstrates tax rates for Californians.

- While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

- Tax rate of 2% on taxable income between $10,100 and $23,942.

- There are no guarantees that working with an adviser will yield positive returns.

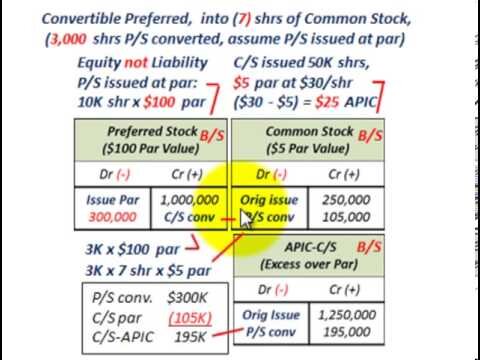

That’s the highest rate in the U.S., but it only applies to income earners with over $1 million in taxable income. The table below further demonstrates tax rates for Californians. The state of California offers a standard and itemized deduction for taxpayers.

Tax rate of 9.3% on taxable income between $132,591 and $677,278. Tax rate of 8% on taxable income between $104,911 and $132,590. Tax rate of 6% on taxable income between $75,577 and $104,910. Tax rate of 4% on taxable income between $47,885 and $75,576. Tax rate of 2% on taxable income between $20,199 and $47,884. Tax rate of 12.3% on taxable income over $677,275.

Fitch Affirms Ratings on Preferred Shares Issued by 12 PIMCO … – Fitch Ratings

Fitch Affirms Ratings on Preferred Shares Issued by 12 PIMCO ….

Posted: Fri, 21 Apr 2023 20:53:00 GMT [source]

Three major state utility companies are proposing a new way to charge their residential customers, and part of billing for electricity would be based on income. View how much tax you may pay in other states based on the filing status and state entered above. California charges sales taxes ranging from 7.25% to 10.75%. The State of California Tax Franchise Board is a wise resource to turn to for information about tax requirements, filing online and paying any liabilities owed. Bankrate’s editorial team writes on behalf of YOU – the reader.

Tax rate of 11.3% on taxable income between $406,365 and $677,275. Tax rate of 10.3% on taxable income between $338,640 and $406,364. Tax rate of 9.3% on taxable income between $66,296 and $338,639. Tax rate of 8% on taxable income between $52,456 and $66,295. Tax rate of 6% on taxable income between $37,789 and $52,455.

You can check its website for 2021 updates, eligibility and estimated benefit amounts. If you are contemplating this as a seller, I would find a very sharp attorney to draw up the agreement. And I would ask the buyer for permission to have a mortgage loan originator run credit in order to qualify the buyer based upon current commercial rates. Enrollment in, or completion of, the H&R Block Income Tax Course or Tax Knowledge Assessment is neither an offer nor a guarantee of employment. Additional qualifications may be required.

Avatud: E-R: 10:00 - 18:00

L: 10:00-15:00 P: Suletud

Avatud: E-R: 10:00 - 18:00

L: 10:00-15:00 P: Suletud